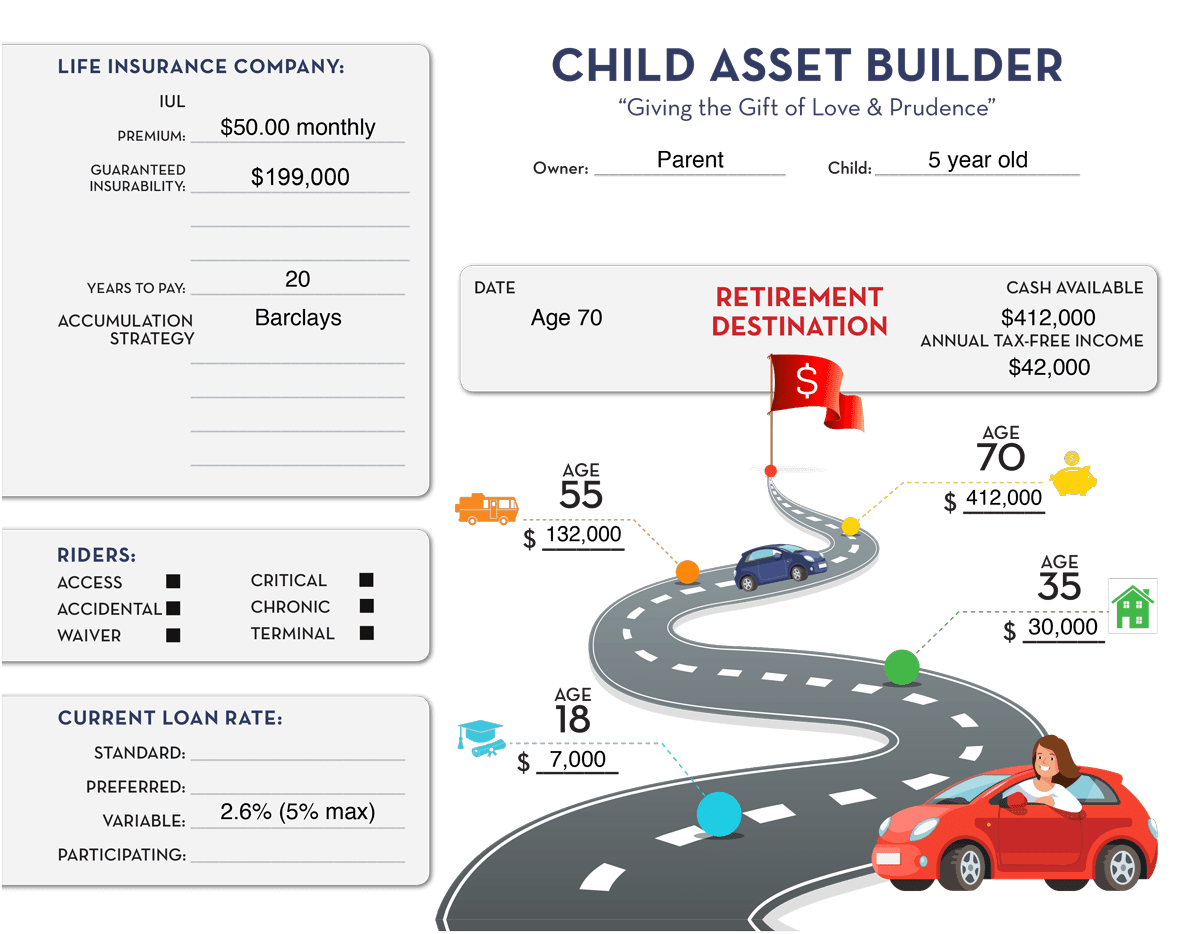

Child Asset Builder:

Giving the gift of love and prudence

Guaranteed insurability

College and emergency funding

A source of supplemental tax free income

Tax deferred accumulation

Leave a generational legacy

You can Leave a Legacy

All of us love our children and grandchildren, but we might not be around to guide them through the financial challenges. Why not leave a legacy of helping them get a head start on savings? Below is an example of what a Child Asset Builder could look like for your child or grandchild.

PARENTS, WHEN YOU PLAN FOR COLLEGE, RETHINK HOW YOU PAY FOR IT

Conventional wisdom tells us that we should plan for college for our children when they are born. I like to evaluate each situation individually.

Navigating the complexities of caregiving

Many of you may find yourself in the same situation I have been in for 15 years, working through how to care for your aging parents or other relatives in a way that honors them, gives them as much independence as possible while keeping them safe, doesn’t harm your mental or physical health and doesn’t bankrupt everyone.

Gaining more than they give

"We continue to participate in the event because we gain more than we give."

Five things kids should know about money

As a life planner and business coach, I find one of the main things people lack is a basic understanding of financial principles. I wonder- how much easier could their lives have been if they'd been taught these basic facts as children?

Life Insurance should be a priority in your financial plan

Sources based on the data shared by Rex Nutting-Market Watch (2016), Surveys conducted by OnePoll for LifeHappens.org (2020), plansponsor.com article retirement concerns remain (2019).