Womens’ Financial Concerns

We can help you.

Life Expectancy

Women have a longer life expectancy.

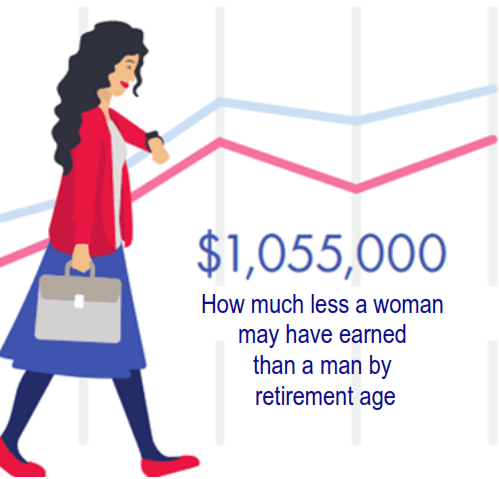

Lower Income

Women generally have lower income then their male counterparts.

Higher health care expenses

Women have 39% higher health costs.

Long-term care

Women are more likely to need long-term care than men.

Longer and more expensive retirement

Higher health care expenses

Women have an average additional life expectancy of 20.6 years after age 65.

Women have

32% lower

retirement account balances on average than men do.

Nearly 2 in 10 women are projected to need long-term care for more than 5 years.

45%

of women plan to work after they retire, or don’t plan to retire at all for financial reasons.

Women have 39% higher health costs on average than men in retirement.

More than 70% of nursing home residents are female.

Women over 65 have 2X the risk of developing Alzheimer’s disease than men.

Protect, Save, Manage Debt, Invest

There are four financial disciplines I consider vital to planning for your future. The order of these disciplines is essential since completing one establishes a foundation upon which to build the next.

Protect

Divorcing? Take Care of Yourself Financially

Unfortunately, divorce is on the rise among all age categories. If you find yourself in a situation where divorce looks inevitable, or you already are in the process of divorce, here are a few financial tips you should keep in mind.

Give the gift of life insurance

Financial Planning without life insurance is like rearranging the deck chairs on the Titanic.

Save

Here’s what to ask yourself at your next financial checkup

With everything going on in your life, why do you make time for your annual physical? Maybe your insurance covers it. Maybe you want to ensure you are in good physical shape and catch any potential problems early. I believe the same can be said for your financial health. To ensure you are in good financial condition and stay that way, you must take time for an annual financial review with a professional.

Manage Debt

Get debt-free….or plan for retirement?

One of the most debated financial questions of modern times is whether you should prioritize paying off your home mortgage over planning for your retirement. The answer to that question often is rooted in emotion more than sound financial wisdom. Emotion embraces the dream of a retirement with no debt, great health, and doing whatever you want whenever you want. However, for the vast majority of Americans, this will not be their reality. Sound financial wisdom says that before blindly adhering to the mantra of paying off your home mortgage as quickly as possible, you should examine your situation to see if it really makes financial sense for you.

Thinking Differently about Debt

People have lots of ideas about debt; some believe there can be good debt and bad debt. Others believe we should avoid debt altogether.

Invest

EMBRACE CHANGE FOR FINANCIAL WELLNESS

What is your standard response to change? Do you resist or embrace life’s transitions? Do you view change as positive, negative, or simply inevitable? I suggest that change is an essential part of life.

Taxes, market volatility and your retirement

When discussing retirement plans with my clients, I always discuss taxes. Taxes can make a huge difference in your income during your retirement years. I believe my clients need to develop retirement strategies that address taxation, while providing sources of supplemental retirement income. Here are some of the specific topics I discuss with my clients.

Additional Demands on Family Finances

Women are 73% more likely to leave the labor market due to caregiving needs than men.

46% of women in two-income households are at risk of being unable to maintain their standard of living in retirement.

A woman’s household income falls 41% after divorce.

On average, women will survive their husbands by 15 years.

32% of women over age 65 are widows.

Don’t fall for the comparison trap

I began thinking lately about the comparisons we women make with other women. We compare our social media posts, homes, cars, children, husbands, careers, body types — the list goes on.

Sources based on the data shared by Rex Nutting-Market Watch (2016), Surveys conducted by OnePoll for LifeHappens.org (2020), plansponsor.com article retirement concerns remain (2019).